Credit cards, Then again, are commonly not amortized. These are an illustration of revolving financial debt, where by the exceptional stability can be carried thirty day period-to-thirty day period, and the amount repaid each and every month could be diversified. Make sure you use our Bank card Calculator For more info or to do calculations involving charge cards, or our Charge cards Payoff Calculator to program a economically possible way to pay back numerous credit cards.

Bear in mind lenders ordinarily reserve the lowest fascination rates for applicants with good credit rating. When you have very poor credit rating and don’t qualify for A reasonable payment — or if there’s a chance you’ll have difficulty repaying the loan — a fast individual loan will not be the best option for yourself at the moment. Take into account strengthening your credit rating in advance of applying for A fast loan.

Wage or wages: This can be the most typical type of profits and incorporates the normal pay back you get out of your employer

Although it can technically be regarded amortizing, this will likely be often called the depreciation expenditure of the asset amortized around its envisioned lifetime. For more information about or to carry out calculations involving depreciation, remember to check out the Depreciation Calculator.

There are two general definitions of amortization. The main would be the systematic repayment of a loan eventually. The second is Employed in the context of organization accounting and is particularly the act of spreading the price of a pricey and very long-lived merchandise above lots of durations. The two are explained in additional element inside the sections beneath.

This information is made use of to prevent fraud. Lenders will NEVER Get hold of your employer to reveal your loan inquiry. If you are on Gains, enter your

If permitted, you might have your hard earned money inside of hrs. But get more info when you’re not a consumer, having your money normally takes around 4 organization times. Non-clients also experience greater minimum amount credit history score requirements, reduce loan quantities and shorter repayment terms.

one. No typical income House loan corporations need to confirm that you can repay a home loan. Normally, Which means investigating month-to-month cash flow depending on W2 tax sorts. But most seniors gained’t have a regular regular cash stream to point out lenders.

When a borrower normally takes out a property finance loan, auto loan, or personal loan, they sometimes make every month payments to your lender; these are typically many of the most typical takes advantage of of amortization. A Component of the payment handles the desire due to the loan, and the rest on the payment goes towards lowering the principal sum owed.

➜

Any individual can make an application for a PenFed loan, however you’ll have to sign up for the credit union in advance of accepting a suggestion. Associates take pleasure in very low interest fees (starting up at 8.ninety nine% as of this creating) and discount rates on several money services and products.

Credit rating bureau – A corporation that actually works to compile the credit histories of will be borrowers in addition to provides these reviews to lenders. These reports are used by lenders for generating selections. Experian, TransUnion and Equifax are the most important credit rating reporting companies in the united states.

You will discover hundreds of economic services and products on the market, and we believe in serving to you realize that is greatest for you personally, how it works, and will it really help you reach your money goals.

HELOC A HELOC is actually a variable-charge line of credit history that lets you borrow funds for your established period of time and repay them afterwards.

Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Nancy Kerrigan Then & Now!

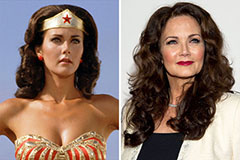

Nancy Kerrigan Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!